by Klarissa Hoday, Tanja Bosshard Becker and Aleksandar Ruzicic

According to a recent OECD report, around one-fifth of healthcare expenditure is wasted. In an era when healthcare budgets are already stretched to breaking point, such waste is unsustainable.

In 2017, the Health Ministers of the OECD concluded in a statement that health systems need to become more outcomes-focused and centred around what matters to citizens and patients. “We need to invest in measures that will help us assess whether our health systems deliver what matters most to people,” they said.

Value-based healthcare (VBHC) reflects this evolution of healthcare systems away from traditional fee-for-service models towards ones that focus on patient outcomes, with the ultimate goal of a healthier population and reduced healthcare expenditure.

Value-based healthcare is an umbrella term that includes concepts such as value-based procurement of services and products, value-based professionals and value-based collaboration (ie, integrated care).

From principle to policy

As health payers around the world seek more value for money, VBHC is moving from principle to policy. The Netherlands has enthusiastically embraced the concept, with a commitment by

the Ministry of Health to provide insight into outcomes for 50% of the disease burden by 2022.

The government is working closely with external stakeholders, including networks of hospitals, to collect data about patient quality of life after treatment to determine what constitutes good care and to enable more shared decision-making.

In Sweden, the SVEUS platform was launched in 2013 to gather knowledge about different populations, hospitals and regions. It uses algorithms to analyse performance and treatments and identify areas for improvement. In the UK, the NHS has introduced integrated care systems, encouraging a shift away from policies that have fostered competition, towards an approach that relies on collaboration between the different organisations delivering care and those paying for it.

And it’s not just policymakers that are recognising the benefits of value-based care. The Erasmus Medical Centre in Rotterdam is introducing a pay-for-performance model for all beds, mattresses and bedside tables.

Meanwhile, in the US, Amazon, JP Morgan and Berkshire Hathaway have joined forces to form ‘Haven’, a non-profit company to create better outcomes and lower healthcare costs for their employees. It aims to do this by leveraging the power of data and technology to drive better incentives, patient experiences and systems.

Many of these examples have been made possible by advances in data and digital technologies, to gather and analyse data, and to provide a holistic service.

An opportunity or a threat for pharma?

On the surface, VBHC appears to be an opportunity predominantly for policymakers to achieve better health outcomes at a lower cost.

And most challenges seem to be on the industry and provider side, particularly the complexity of defining and measuring ‘value’, and then delivering on that value. So, does that mean more work and complexity for less reward?

Well, not necessarily. This is about the evolution of entire healthcare systems away from a process, symptom-specific and silo- driven approach, towards one that is holistic, long term and based on outcomes.

The pharmaceutical industry is very well positioned to be a major player in VBHC. Pharmaceutical companies are already experts in collecting, analysing and interpreting data. Some already consider themselves ‘medicines and data science companies’, such is the growth in importance of big data in healthcare in recent years.

Combine that with their global reach and resources, enabling them to research and identify optimal value-based models, and companies should be well positioned to play an active role. The truth is, they have little choice.

The train is already moving…don’t get left behind

VBHC is a macro trend that will happen with or without the industry – the train has already left the station and it’s time for pharma companies to get onboard, if they haven’t already. But they can’t simply hop on and off as they please.

If companies try to cherry-pick elements of VBHC that serve their immediate needs without engaging holistically, they will lose credibility and jeopardise their long-term involvement. Companies will instead have to think more strategically about the role they want to play in the entire treatment pathway for each condition, and how to subsequently structure their product and service offering.

Some companies have recognised this and are striving to implement programmes. In Manchester, the local health authority has formed a partnership with GSK to tackle COPD in the area. One aspect of the partnership will see GSK contribute towards the costs of a review by pharmacists of COPD patients to identify those who might benefit from a change of drug regime. There is talk about supplying software that, when applied to patient records, can spot those most at risk of developing particular conditions.

Solutions like this are easier to implement in disease areas where outcomes can be measured relatively easily, where there is transparency of outcomes and cost, and where there is a higher level of integration of care. But one could argue that industry should focus its VBHC efforts in disease areas where outcomes and total healthcare costs are most volatile, due to the potential for a hugely beneficial impact beyond the drug, for example with patient compliance.

The onus is on the industry to help to define the value of its own products and the earlier it starts considering this in the product lifecycle, the better. By including a VBHC analysis related to care in the specific disease area (including what different stakeholders value and their willingness to pay) at the start of the development process, companies can tailor the product and focus on needs ‘beyond the pill’. They can also engage in partnerships that build goodwill and trust, which may be of great value in cases where trial outcomes are not as hoped.

Towards co-creation

Industry can build on its role as a partner in disease management and become a key stakeholder in the governmental, legislative and civil society dialogue on VBHC. This effort can be driven at a company level, but is equally important as part of the commercial strategy for each asset or solution. This means both offering holistic solutions and partaking in the environmental evolution towards a sustainable value-based healthcare environment.

As well as the commitment at a strategic level, companies must also address organisational challenges in order to take advantage of such opportunities. This may mean establishing new standards of health informatics (usually via digital technologies) to measure outcomes and deliver holistic solutions.

It may mean breaking down (structural and budget) silos within the organisation and ensuring all key internal stakeholders are fully invested into treatments that address meaningful, not incremental, improvements. It may mean working with external stakeholders to move away from process-driven reimbursement and process-driven healthcare provision.

As a first step, companies need to move away from purely short-term annual focus to a long-term business transformation one. VBHC is happening regardless; it’s time to get on board. This also means that the days of ‘mere’ pill provision are over – companies have to think about holistic, patient-centric solutions from the start of the life cycle.

Identifying the right partners is key

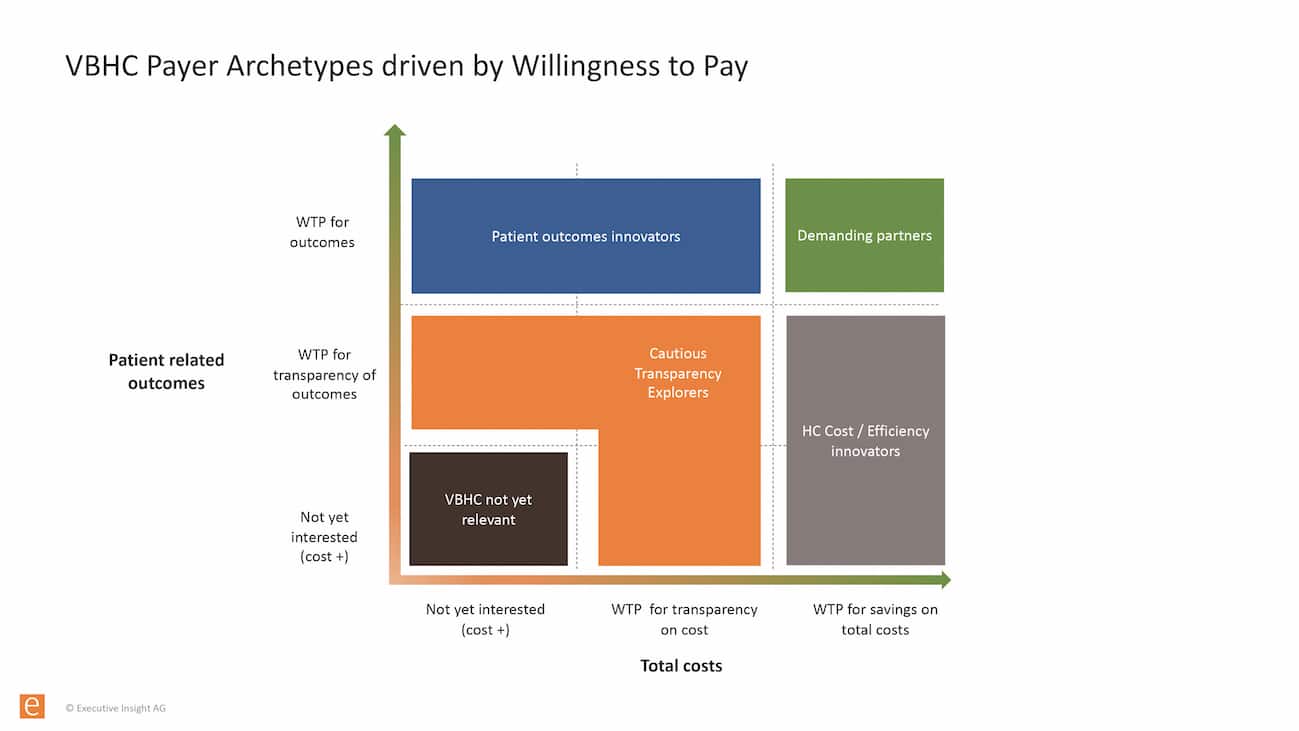

At this point, not all systems or stakeholders are willing to pay for outcomes and/or savings on total costs – but many are starting to realise that it pays to create transparency and therefore that it is worth doing.

In order to help pharma companies take the first step on the journey towards VBHC, Executive Insight has created System Archetypes based on two dimensions: ‘Patient-related outcomes’ and ‘Total costs’ (see figure below).

The companies that are able to identify the systems and stakeholders willing to pay for both outcomes and savings on total costs will be able to implement novel business models,

learn from their experiences and improve their offerings for further roll-out, thereby shaping that specific disease area globally.

First steps towards VBHC

In summary, pharmaceutical companies must get on board the moving train of VBHC: integrated outcomes-focused health systems that involve all stakeholders in improving value will do better in the longer term, to the benefit of all. To do so, the key steps are as follows:

- Conduct a VBHC analysis early in the product life cycle

- Strategically plan towards long-term patient outcomes in line with VBHC principles

- Ensure organisational set-up reflects VBHC, moving away from product-centric silos

- Build capabilities to deliver holistic solutions

- Establish new standards of health informatics (usually via digital technologies) to measure outcomes

- Have a co-creation mentality with external stakeholders to move away from process-driven reimbursement and process-driven healthcare provision

- Identify suitable partners.