The BioIndustry Association (BIA) has called on the UK government to introduce tax concessions for individuals who wish to invest in innovative national businesses.

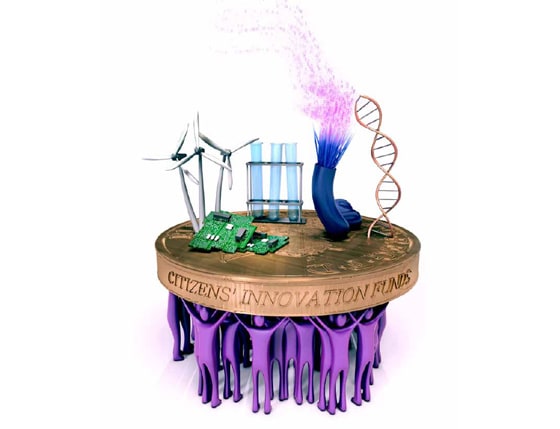

The Citizens’ Innovation Funds (CIF) would “unlock the patriotic potential” of UK investors and is modelled on a similar scheme in France called the FCPI, which was set up in 1997 and to date has raised more than €6bn for over 1,000 companies.

The CIF could raise £300m for innovative UK businesses and create 1,500 new jobs, said the BIA in a new report, which notes that funding for innovative companies in Europe is seven times lower than that available for firms operating in the US.

The initiatives are examples of crowdfunding, in which a group of individuals and organisations can pool their resources to support a project financially in this case via equity investments.

The UK government should support the CIF and should make this approach more attractive by providing income tax breaks to investors, who would be allowed to invest up to £15,000 in ventures.

“For entrepreneurial companies, the ability to access new capital would enable them to grow faster, employ more people and pay tax sooner than otherwise possible,” said BIA chief executive Steve Bates.

The money raised in this way would be pooled and used to support “innovative, research-intensive companies”, and would be allocated “not by government but by knowledgeable investment professionals”, according to Bates.

In addition to France, there have also been moves in the US to make crowdfunding schemes legal for a limited amount of early-stage equity financing, and these came to fruition earlier this year with the signing into law of the Jumpstart Our Business Startups (JOBS) Act.

The legislation increased the number of shareholders a company can have before it needs to register its common stock with the Securities & Exchange Commission (SEC), does away with a lot of the bureaucracy for crowdfunding and other small stock offerings and increases the amount an individual can invest in this way per year.

The CIF would provide similar benefits for UK companies “at a time when new ideas are needed to boost the UK economy,” said Bates.

“For companies access to such cash could prevent them from being sold at the earliest opportunity and allow them to maximise the potential for development and become a ‘British Google’, a ‘British Apple’ or a ‘British Amgen’,” he added.