Solid growth of Biogen Idec’s multiple sclerosis (MS) drugs Tysabri and Avonex helped lift the company’s fourth quarter revenues by 7 per cent to $1.4bn, although profits slipped slightly to $292m on tax charges.

Solid growth of Biogen Idec’s multiple sclerosis (MS) drugs Tysabri and Avonex helped lift the company’s fourth quarter revenues by 7 per cent to $1.4bn, although profits slipped slightly to $292m on tax charges.

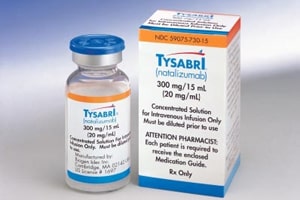

Tysabri (natalizumab) continued its run of growth with a 10 per cent gain in sales to $295m in the quarter, while older MS drug Avonex (interferon beta-1a) put in yet another good quarter with revenues up 7 per cent to $753m. Worldwide sales of Tysabri – factoring in those booked by partner Elan – rose 14 per cent to $433m.

For the full-year, Biogen had sales of $5.5bn – up 9 per cent – on 2011, while Tysabri sales were up 5 per cent to $1.1bn and Avonex revenues rose 8 per cent to $2.9bn.

Biogen chief executive George Scangos described these sales as a “turnaround” performance after “years of declining market share”.

Added momentum was lent to the Avonex franchise by the introduction of a new pen injector formulation and a kit to help reduce the frequency of interferon-related flu-like symptoms, while Tysabri has benefitted from the use of its JCV antibody companion diagnostic that can screen patients at risk of serious side effects.

The strong performance of Biogen Idec’s current crop of products helped boost earnings per share (EPS) at the company to $6.53 – a rise of 11 per cent – and future prospects are underpinned by a new generation of products nearing the market, said Scangos.

These include oral multiple sclerosis candidate Tecfidera (BG-12 r dimethyl fumarate), which rival drugmaker Teva has tried to block on safety grounds via a citizen’s petition to the US FDA, as well as a long-acting pegylated version of interferon beta-1a and haemophilia treatments based on recombinant factors VIII and IX, all of which have cleared phase III trials.

Tony Kingsley, Biogen’s executive vice president of global commercial operations, said the company is hopeful of securing approval for Tecfidera in the US in March and the EU in the first half of 2013, with Germany and Canada expected to be the first non-US launch markets.

“We are poised to begin what we expect will be a remarkable period of growth,” commented Scangos. Biogen expects 2013 revenue growth to be 10 per cent with EPS of between $7.15 and $7.25.