Switching from Johnson & Johnson’s Remicade to a biosimilar version caused no safety issues, and the copycat drug worked just as well, says a new study.

The finding should lay to rest what has been termed biosimilar resistance, a reluctance to prescribe the copycat drugs because of concerns they are somehow inferior to the brand.

The comparative trial – called NOR-SWITCH – was presented at the 2016 UEG Week in Vienna, Austria and showed that swapping from Remicade to a biosimilar version made by Celltrion posed no problems for patients regardless of the disease for which they were taking the drug.

Worsening of disease was primary measure in the trial, and this occurred in 26.2% of those who remained on Remicade and 29.6% of those who switched to the biosimilar, a difference that did not reach statistical significance.

“We conducted this study to assess how switching to biosimilar infliximab affects patients who are stable on the originator biologic,” said Jørgen Jahnsen of the University of Oslo in Norway, the principle investigator in the trial which was sponsored by the Norwegian government.

“The data shows that safety and efficacy are maintained post-switch and should give confidence to physicians looking to move their patients onto biosimilar infliximab for non-medical reasons such as cost,” he added.

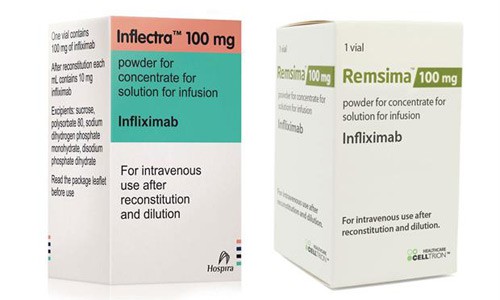

South Korea’s Celltrion was the first company to get approval for a biosimilar of a monoclonal antibody drug, claiming EU approval for its Remsima product – sold by Mundipharma as well as by Pfizer as Inflectra – in 2013.

Since then the two biosimilars have taken 30-40% market share from Remicade in Europe, where it is sold by MSD, thanks to pricing that puts them around a third cheaper than the branded product.

In Norway, where the discounts are much higher at 70% – the biosimilars have just about achieved complete market penetration, with 90% or more prescribing rates also seen in Denmark and Finland. Conversely in Sweden – where switching is not endorsed – the biosimilars have around a third of the market.

Last year, MSD reported that sales of the drug fell 24% to $1.8bn as competition drove down pricing, a situation that only looks likely to get tougher. A third biosimilar player entered the market last month when Biogen launched its Flixabi product, developed by joint venture partner Samsung Bioepis.

Meanwhile, J&J is also facing imminent competition to Remicade in the US, after Celltrion and Pfizer bagged FDA approval for Inflectra earlier this year.