Pharma’s road to omnichannel engagement excellence is paved with opportunity and risk.

Current progress is variable, with leaders making impressive strides but laggards – incredibly – only just beginning to dip their toes in the water. In the crowded middle ground between them, many organisations are experimenting with new technologies and attempting multichannel campaigns.

However, their use of digital innovation is too often driven not by coherent strategy, but by the fear of missing out. It’s the wrong motivation.

The potential for digital to transform the customer experience is significant – but suboptimal practices, piecemeal tactics and channel-first thinking means that many companies are at risk of squandering the opportunity. There’s still a long way to go.

The need to master omnichannel engagement is pressing. Consumer expectations have been redefined by digital disruption, dramatically reshaping the buyer’s journey and forcing businesses to reimagine their commercial model.

Research suggests that the average B2B buyers are now two-thirds of the way through their purchasing journey before they talk to sales, highlighting the importance of high quality digital engagement earlier in the buying cycle to usher prospects through the ‘funnel’.

But digital marketing isn’t simply a factory for marketers to generate leads then pass the baton on to sales. Customers need support at every touchpoint along – and beyond – the buying journey, with online channels permanently on hand to deliver timely and relevant content. The challenge is to deliver a seamless experience as customers move between channels.

That’s the definition of omnichannel excellence – and it’s the holy grail in B2B.

Naturally, pharma’s engagement with its customers has its own unique complexities – but the basic principles of modern-day communication naturally transcend all sectors. Traditionally, pharma’s dialogue with prescribers has started with the sales rep and been driven by a ‘share of voice’ model.

However, a widespread shift in customer behaviours is forcing companies to extend the operational role of marketing to bolster engagement at every touchpoint of the buyer journey.

With the clinical market now dominated by digital native healthcare professionals (HCPs) – and with access to traditional customers reducing – it’s clear that the effective and co-ordinated use of personal and non-personal (digital) channels is key to commercial success. So how is pharma getting on?

Multichannel maturity 2019

According to the Across Health Multichannel Maturometer 2019 study, the pace of digital transformation across pharma is as slow now as it was in 2015.

Moreover, while 90% of the industry believes pharma will be disrupted by digital technologies, well under half think their companies are preparing adequately for the inevitable. It’s a perception that provides powerful context for the multifaceted multichannel challenges facing pharma in Europe.

The Maturometer study, now in its 11th year, allows companies to benchmark their own multichannel performance against their peers in four core areas: people, strategy & organisation; business processes and technology; measurement; multichannel integration.

The 2019 results reveal that 87% of respondents think their companies are still some distance from being ideal organisations in terms of their ability to use digital to improve customer engagement and business impact.

Furthermore, satisfaction with digital is simply not increasing; little more than 10% are satisfied with their company’s digital/multichannel activities, mirroring satisfaction levels reported in 2010.

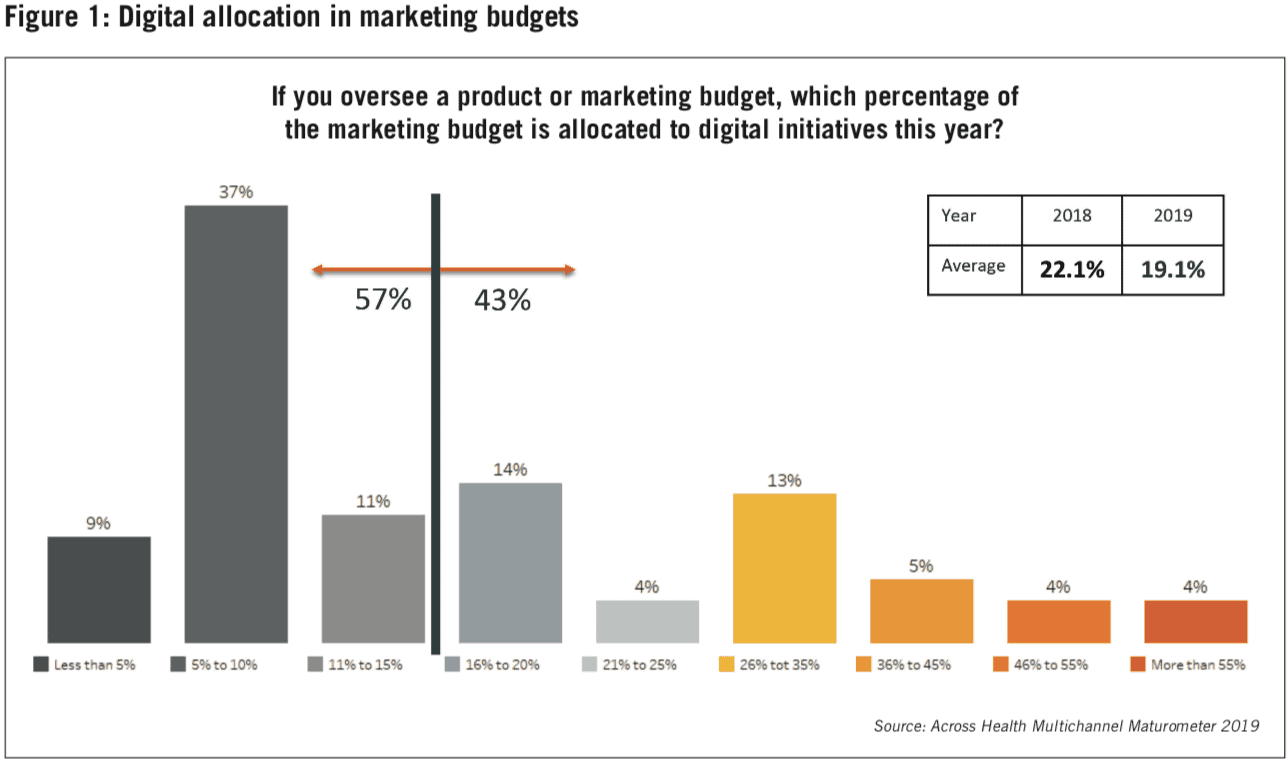

However, despite the apparent failure to gain ground, pharma’s investment in multichannel has reduced in the past 12 months. After three consecutive years of robust growth, digital marketing budgets have fallen to 2017 levels – with 57% allocating less than 15% of their marketing budget on digital.

The average allocation – 19.1% – is lower than in 2018 (Figure 1). But the law of averages disguises a digital dichotomy: there are lots of laggard beginners with small budgets being hidden by the more advanced companies that are spending a lot.

Investment in digital

So where is that investment going? The ‘multichannel rep’ is growing in strength, with reps increasingly equipped with digital tools like tablet e-Detailing and approved email.

However, remote detailing and eRep capabilities continue to lag. On the marketing side, product/disease websites and eNewsletters are the most popular tactics (Figure 2), while web banners on third party media remain a prominent approach.

Patient websites and HCP self-service portals are already standard practice in almost half of companies, while the number of pilots in these areas suggests penetration is likely to increase further.

In terms of the adoption of digital technologies, content management systems are by far the most widely used, while marketing automation tools are rising fast. However, health tech solutions like AI, chatbots, wearables and predictive analytics are only just on pharma’s radar.

The use of technologies to help personalise content – a key area for pharma as customers reject ‘noise’ and look for more targeted content – is standard practice in less than a fifth of organisations.

If pharma is to reap the benefits of personalisation and harness the opportunities of marketing automation, companies need to strengthen their customer insight capabilities and build a 360 degree view of the customer through better integration of marketing and sales.

Strategy and skills

However, to focus on investment in channels and technologies is to start in the wrong place. Companies need to think customer-first not channel-first, and this should be reflected in a clearly defined upfront strategy.

“Some organisations still make the mistake of starting with tactics,” said Fonny Schenck, CEO, Across Health.

“However, best practice begins with defining strategic imperatives then identifying the proxies that will translate them into something actionable. For example, what are the behavioural objectives, leverage points and associated messages needed to generate the greatest impact?

“Then it’s a matter of determining how you will achieve conversion; which content or services will drive the action/change you want? It’s only once you’ve been through these three steps that you can begin to consider tactics and channels. Unfortunately, many companies start in the wrong place.”

The 2019 Maturometer backs this up. When asked about their priorities, digital teams believe their companies should focus much more on strategy than on enablers like technology, tactical content and campaign development.

Suboptimal strategy is highlighted as one of the biggest barriers to digital transformation in pharma; managers believe that the absence of a clear strategy is a real obstacle, while the perceived lack of internal knowledge around digital is another cause for concern.

The strategy void is even stronger in ‘emerging’ digital functions like medical and sales, where ‘lack of strategy’ and ‘no clear business case’ for digital are the top two bottlenecks.

The digital skills gap is a long-standing problem. Less than a quarter of respondents (23%) believe their companies have strong digital/multichannel teams (with board support), while only 7% completely agree that their staff are well trained in digital skills.

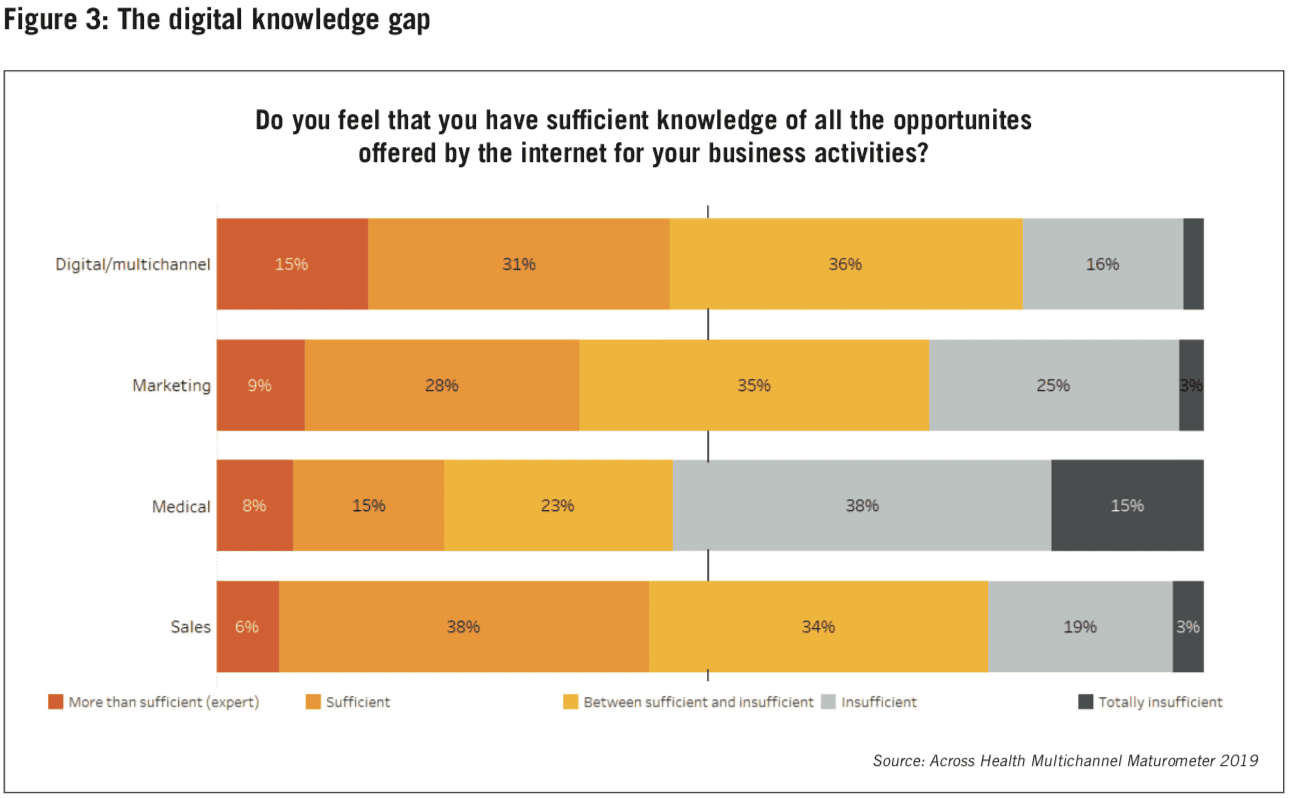

“In order to define and execute a solid strategy, you of course need motivated and skilled people who know the business and how technology can galvanize and transform it,” said Fonny. “This key condition for success remains elusive in pharma: in 2019, less than 10% of the business functions – marketers (9%), medical (8%) and sales (6%) – feel they are digital experts. For digital/multichannel teams the picture is – perhaps surprisingly – only marginally better (15%).”

Remarkably, almost two thirds of marketing (63%) don’t believe they have sufficient knowledge of digital opportunities (Figure 3).

One of the biggest areas of perceived weakness is the ability to make decisions around ‘channel mix’; just 8% fully believe that this challenge has no secrets for them. This clearly illustrates the need to reinforce capabilities in this vital area.

However, while digital teams increasingly believe that they’re well integrated within their business, more than half (52%) don’t think they’ve got robust processes in place to help them define the right channel mix. And less than a fifth think their company has robust technology (17%) and strong SOPs (15%) to enable its digital strategy.

The key to digital transformation

So what does all this mean? The Across Health study once again reveals huge variation in digital maturity across the industry. A surprisingly high number of companies are still not doing digital activities at scale, preferring to invest in third-party media or isolated activities that suffer through a lack of integration.

Others have progressed further, adopting approaches ranging from single-channel pilots or cross-channel campaigns to the use of multiple sales and marketing channels in glorious isolation.

The most advanced have created a platform for more coordinated sales and marketing activity, marking a shift from ‘share of voice’ model to a ‘quality of voice’ approach based on a 360 degree view of the customer. This is the gateway to omnichannel excellence.

However, technology alone is not enough. “Success is about focusing on the ‘hard and the heart’,” said Fonny.

“Many of the ‘hard’ enablers are already in place; multichannel rep technology is omnipresent and most basic channels are commonplace; sizeable digital teams exist at both international and local level, and even marketing automation is beginning to rise through the ranks. However, the missing enablers are the human ones; the skills, culture and organisational capability that help to win hearts and minds.”

Fundamentally, says Fonny, there are four key components that must be in place to ensure a successful digital transformation. “Primarily, you need a robust, quantified business case – a ‘burning platform’. Secondly, this must be underpinned by a solid strategy, roadmap and vision. Thirdly, you need a coherent set of technological, organisational and skills enablers – the ‘hard’ and the ‘heart’. Often companies believe that if they invest in the tech, the rest will follow. It won’t. You have to invest in both.

And finally, you have to work out where you’re going to start. This crucial aspect is often overlooked. Companies want to see quick wins, so it’s important to plan ‘multiple shots at the goal’ and short time-to- impact first steps. The most successful companies embrace agility; they experiment, learn, grow and adapt, and empower their teams with the hard and soft enablers to make change happen.”

The 2019 Multichannel Maturometer confirms that pharma still has work to do in all four areas – not least the all-important component of capability- building at all levels. The digital dichotomy at the budget level shows that the market is moving at two speeds, with leaders going from strength to strength and laggards failing to move forward.

The leaders of tomorrow will be those who align their businesses around the customer to deliver personalised journeys and omnichannel experiences that are fit for the 21st century.