The Asia Pacific (APAC) region has been a strong contributor to the pharmaceutical industry’s global market growth for several years.

Can such growth be sustained? And to what extent will it be driven by innovation? While various studies have examined innovation more broadly – at the global level and/or with a methodology applicable to multiple industries – none has been sufficiently focused to paint a vivid picture of the APAC region’s future.

The following fresh perspective on innovation in the APAC pharma market is excerpted from a data-driven analysis that ranked companies on their degree of innovation, using a methodology expressly developed for less mature markets. The full report is free to download and is available from Clarivate Analytics.

A multi-faceted approach to measuring innovation

There is no agreed-upon definition of what constitutes innovation in the pharmaceutical industry and there is no accepted surrogate marker for it. Even the most general definition of innovation (the creation of a new good or service that generates value) is not easily applied. How is ‘newness’ defined? How is the value of a therapy measured?

We therefore developed a bespoke methodology based on a set of largely quantitative parameters that encompassed a company’s broad innovation ecosystem.

These included factors ranging from academic alliances to the degree to which R&D is translated into actual drug pipeline. We then grouped the individual data parameters into three major indices: early-stage partnering, drug development and maturity.

A quantitative approach

As the goal was to measure innovation at the company-level, the first challenge was to determine the parameters that would best measure innovation in less mature markets. The resulting quantitative measures were primarily related to pre-development conditions and decisions (see: A multi- faceted approach to measuring innovation).

The extensive analyses applied a customised scoring mechanism to rank-order a cohort of 929 companies out of a universe of 46,509. The analysis was confined to pharmaceutical and biopharmaceutical products, with innovation in drug delivery, devices and diagnostics considered as out of scope.

The study used data collected until the first quarter of 2019 to understand the following when looking at 14 APAC countries/regions:

- Which countries are most conducive to innovation?

- Which companies are leading the way?

- Which companies are on the cusp of seizing growth fueled by innovation?

- How does a company’s innovation profile affect its success?

A mixed macro environment

The degree of innovation in a country is necessarily influenced by a variety of social, economic and regulatory factors – some that encourage innovation and others that inhibit it. We examined these factors for Mainland China, Japan and South Korea, concluding, very broadly:

- In Mainland China, innovation is spurred by several conditions: the sheer size of the population, an increase in lifestyle diseases, the shift away from state-ownership of enterprises, and the government’s investment in healthcare and regulatory reviews. Tempering this, the country relies almost exclusively on generics, is still overcoming counterfeiting issues, regulates prices heavily and lags behind other countries in the percentage of GDP spent on healthcare.

- Japan is the scene of opposing incentives for innovation. On the one hand, the government aims to accelerate R&D and is funding projects that make use of artificial intelligence (AI),is reviving the research-based industry and is promoting drugs of Japanese origin in global markets. At the same time, the economy is facing challenges, the population is ageing, punitive pricing schemes are impacting smaller, domestic companies and the government has set a target of 80% generic substitution by 2020.

- South Korea is an innovation-friendly environment, as the government is driving growth in the pharmaceutical and medical instrument sector and is pushing for an expanded presence in the global biotech market. The government provides policy loans and tax incentives for innovation and is striving to reduce approval times and increase its share of the global market, while the Korea Pharmaceutical and Bio-pharma Manufacturers Association (KPBMA) is investing in an AI platform for drug development.

Strong regional pipeline

Pharmaceutical companies are prolific in the APAC region. At the time of our analysis, there were 5,547 drugs in active development in the region and 1,509 that have been launched. Of all countries we studied, Japan has the highest number of drugs in active development (nearly 2,000), which is not surprising given the country’s market maturity. Less predictable is the large number of drugs in development in both Mainland China (1,598) and South Korea (1,088).

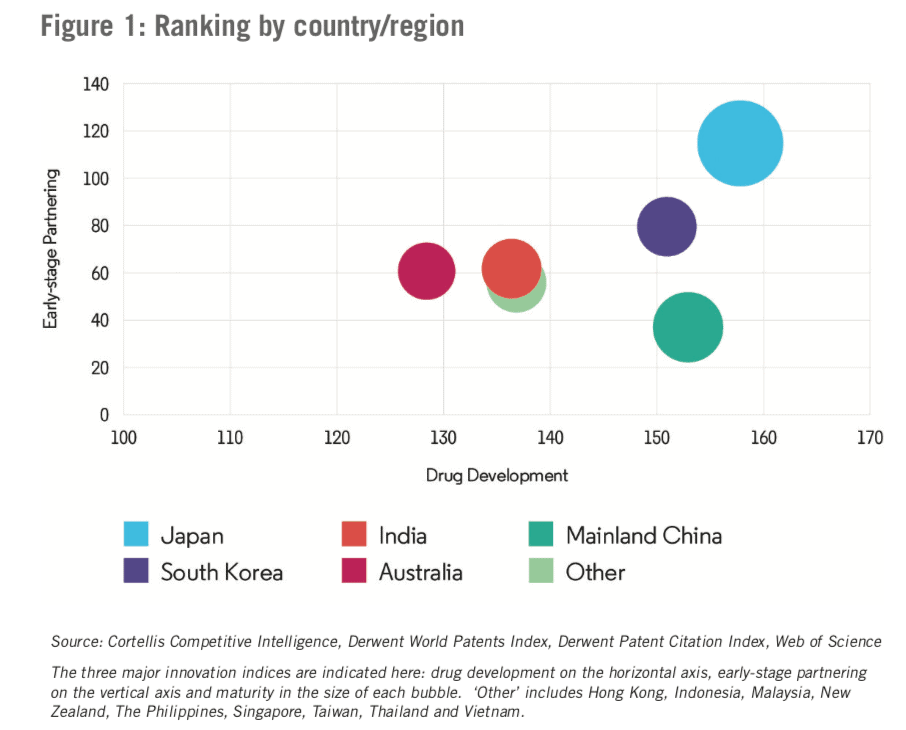

As Figure 1 shows, Japan earned the highest score on a country/region level, having achieved high scores in all three innovation indices. South Korea is a strong challenger to Japan’s dominance, lagging behind only slightly in terms of drug development and early-stage partnering. The country’s low maturity innovation score indicates that it has yet to deliver on its potential. The other APAC countries/regions, while relatively strong in drug development, are weaker in early-stage partnering.

Within our data set, Mainland China has by far the largest number of pharmaceutical company headquarters (325), followed distantly by South Korea (151), Japan (140) and Australia (130).

Company-level results

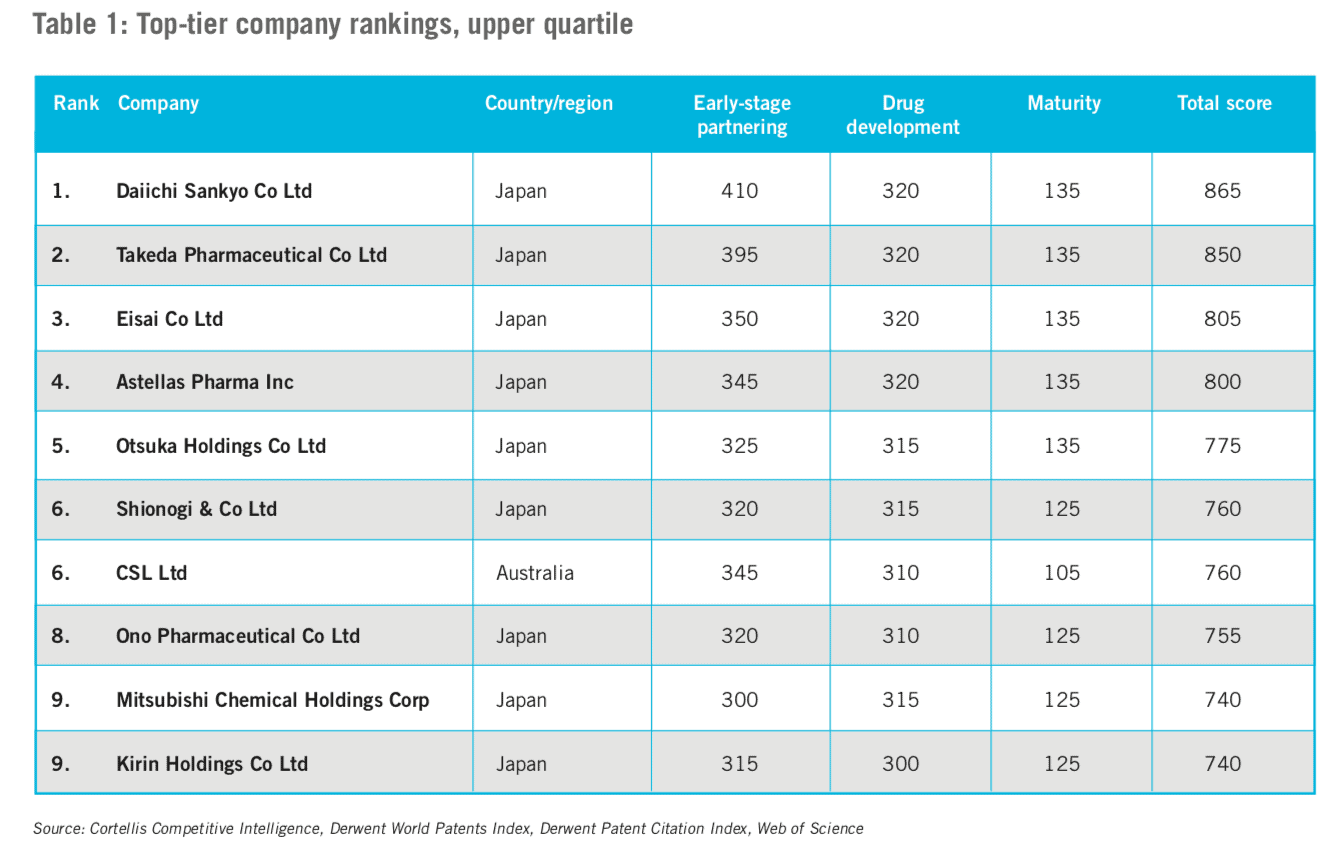

We separated the larger, more established companies – for our purposes, defined as those that have launched ten or more products (this included many multinational companies). We labelled this grouping as ‘top-tier’ companies and ranked them by their overall innovation score, (the upper quartile of this list appears in Table 1).

All of the top-tier companies garnered high marks across all three innovation indices. These companies scored the weakest on early-stage partnering, which suggests there is still an opportunity for them to increase the number of their partnerships with academic institutions.

Three observations were immediately apparent from the list of top-tier companies:

- There is a link between innovation scores and revenue. All of the companies in the upper quartile fall within the top 50 global companies in terms of revenue.

- Japanese companies dominate. Nine out of the top ten are headquartered in Japan, as are more than half of all companies on the list.

- Mainland China is underrepresented – for now. Only one company headquartered in Mainland China is among the top 40 innovative companies in APAC, even though there were more companies from Mainland China in the sample than from any other country.

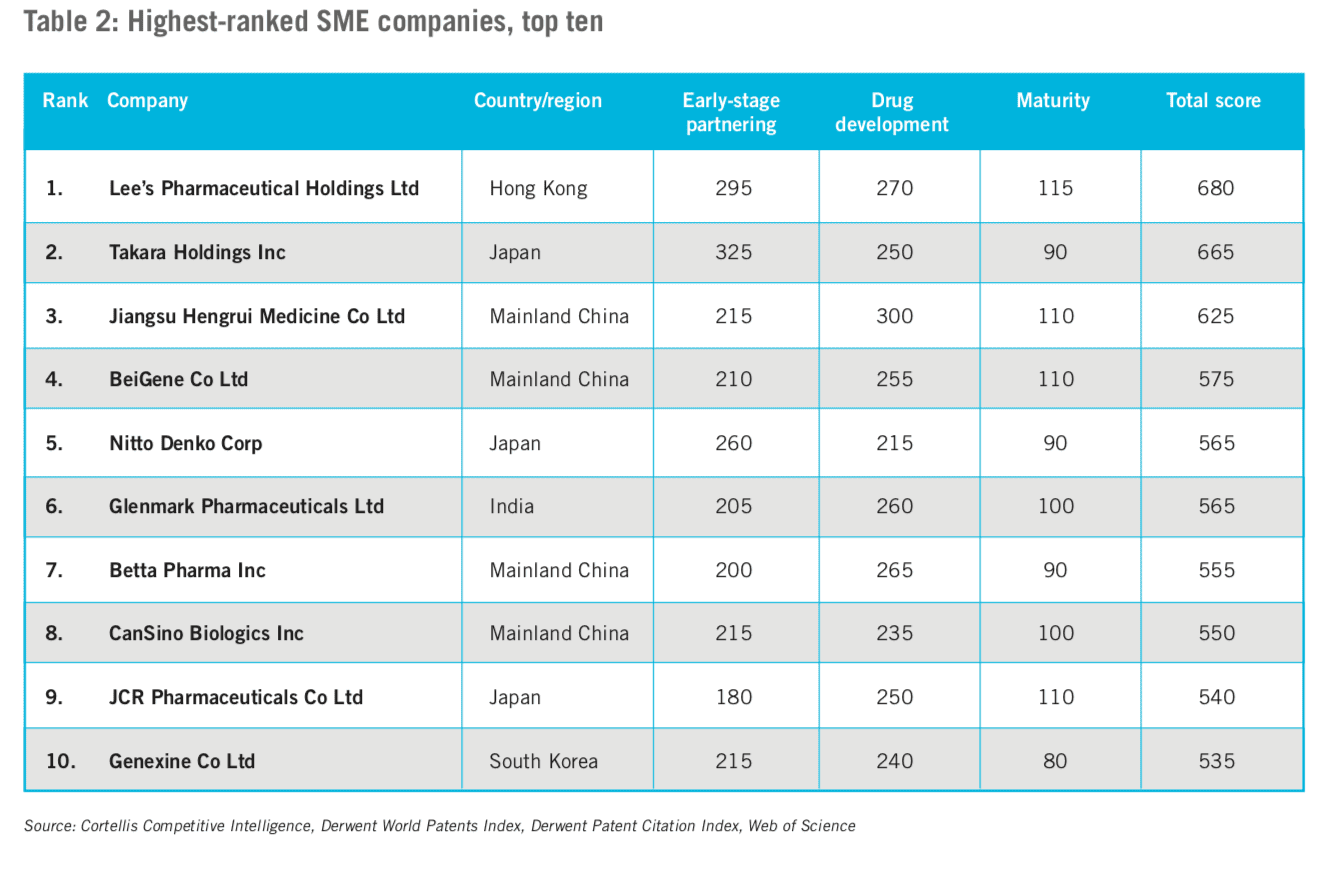

Those companies with fewer than ten marketed products were considered ‘small and medium- sized enterprises’ (SMEs) (the top ten from the list of 100 appears in Table 2). Given the rank-ordered list of the top 100 SMEs, we noted that:

- The correlation between each of the three indices is less pronounced in this tier (many on the list have yet to bring a product to market or expand internationally).

- Companies in Mainland China figure most prominently with more than a quarter of the entrants.

- The top-ranked SMEs score especially high on early-stage partnering, suggesting that this element is integral to their success.

- All of the top ten SMEs earned high scores on drug development.

- The top ten SMEs show much greater variability between their maturity and composite scores than on other measures.

Innovation outlook

As the macro-environment within the region changes, the scores for the parameters measured in this study will likely shift.

Although there will be continued pressure on healthcare spending in Mainland China, the future looks promising overall for R&D there, and the number of innovative drugs introduced is likely to increase.

In particular, Mainland China’s heavy investment in cancer therapies should pay dividends in terms of new product launches and government regulatory reforms should speed new drug approvals.

In Japan, we expect that ranking scores for companies will differ more widely by company size, with market pressures affecting SMEs more dramatically than top-tier companies. There may be a drop in the country’s scores for early-stage partnering and drug development. Cancer will remain a growth market, although Japan is currently experiencing price containment pressures that other countries will also ultimately face.

The outlook for innovation in South Korea is largely positive, thanks to government incentives to encourage foreign investment. For the country to raise its Maturity score, it will need to carry more drugs successfully through to commercialisation, a goal that should be helped by the government’s growth targets and support for investment in AI systems.

Conclusion

The APAC region is a rich source of innovation, but in most countries/regions – Japan being the exception – this is not translating into a strong global footprint.

Currently, the world as well as local entities are not benefiting fully from companies’ innovative activities. However, collaboration opportunities abound for APAC-based and Western companies to reverse this trend and accelerate innovation.