M&A activity among specialty pharma companies shows no signs of letting up, with Alexion announcing an $8.4bn deal to buy rare disease company Synageva BioPharma.

The cash-and-stock deal equates to $230 per Synageva share, a hefty premium on the company’s closing share price of just under $96 yesterday. Shareholders in Synageva will get $115 and 0.6581 of an Alexion share for each share they own in the Massachusetts-based biotech.

Alexion’s interest in Synageva lies mainly in breakthrough drug candidate Kanuma (sebelipase alfa), which is being developed as an enzyme replacement therapy for lysosomal acid lipase deficiency (LAL D), a genetic disease that is often diagnosed in childhood and has a near 100% fatality rate.

Although LAL-D is rare, affecting just 1-2 per million births, the seriousness of the disease and lack of current treatments means analysts have predicted upwards of $650m a year in potential sales for Kanuma, with some putting the peak at more than $1bn.

The FDA agreed to start reviewing Synageva’s marketing application for Kanuma earlier this year and is due to deliver a verdict on the drug by September 8, with the EMA also agreeing an accelerated assessment for the application.

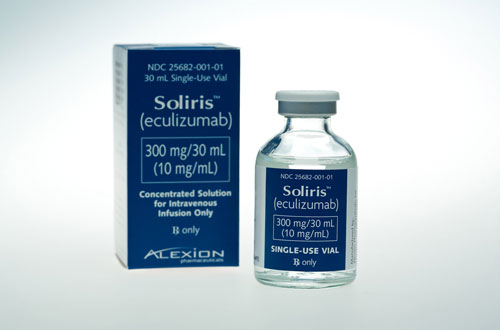

Kanuma adds to Alexion’s own rare disease franchise, currently headed by Soliris (eculizumab) for rare blood clot conditions paroxysmal nocturnal haemoglobinuria (PNH) and atypical haemolytic uraemic syndrome (aHUS) which pulled in more than $2bn last year thanks to its $500,000 a year price tag.

The combined company could have three rare disease therapies on the market by the end of the year, with Alexion also hoping to launch Strensiq (asfotase alfa) for hypophosphatasia (HPP) in 2015. Synageva would also contribute a clinical development candidate called SBC-103 for mucopolysaccharidosis IIIb, known as Sanfilippo syndrome, which is in phase I/II trials.

Aside from the opportunity to build a broader rare disease product portfolio, Alexion also sees potential cost-savings of around $150m from the merger.

There has been frenzied activity in the mid-cap specialty pharma sector in recent months, with particular interest in companies with rare disease drugs that combine a clear clinical benefit with the ability to charge high prices.

In recent weeks Shire agreed the takeover of NPS for $5.2bn, largely on the strength of rare disease therapies short bowel syndrome drug candidate Gattex (teduglutide) and Natpara (recombinant parathyroid hormone) for hypoparathyroidism.

Meanwhile, Horizon Pharma stumped up $1.1bn for urea cycle disorder specialist Hyperion Therapeutics and BioMarin bought Prosensa for $840m, gaining access to its muscular dystrophy drug drisapersen.