On the eve of an update for investors, Sanofi has agreed to buy US biotech Synthorx for around $2.5bn in cash, bolstering its immuno-oncology pipeline.

The French drugmaker is paying $68 per share for Synthorx – a 172% premium on the biotech’s closing share price on Friday – bolting on a pipeline of ‘synthorin’ drugs for cancer as well as autoimmune indications, headed by a drug for solid tumours that is in a phase 1 trial.

New Sanofi CEO Paul Hudson (pictured below) was recently reported to be looking into a possible sale or spinout of Sanofi’s consumer health operations as well as other divestments – following a path trodden by the likes of AstraZeneca and Pfizer – in order to raise cash for internal R&D and bolt-on deals to boost the pipeline.

Sanofi CEO Paul Hudson

The deal is “aligned with our goal to build our oncology franchise with potentially practice-changing medicines and novel combinations”, said Hudson.

The Synthorx deal is his first play, and adds a technology platform that came out of the lab of Dr Floyd Romesberg of the Scripps Research Institute. Synthorins are proteins that are modified using a base pair technique to improve their characteristics.

Lead candidate THOR-707 is a pegylated, modified version of interleukin-2 (IL-2) that is being tested against multiple tumour types, and will be tested in combination with Sanofi’s current cancer drugs.

The modification extends the time the drug stays in the body compared to regular IL-2 or aldesleukin – which has been used for years to treat melanoma and kidney cancer – but also blocks side effects such as vascular leak syndrome (VLS) which can be fatal and limit IL-2’s usefulness.

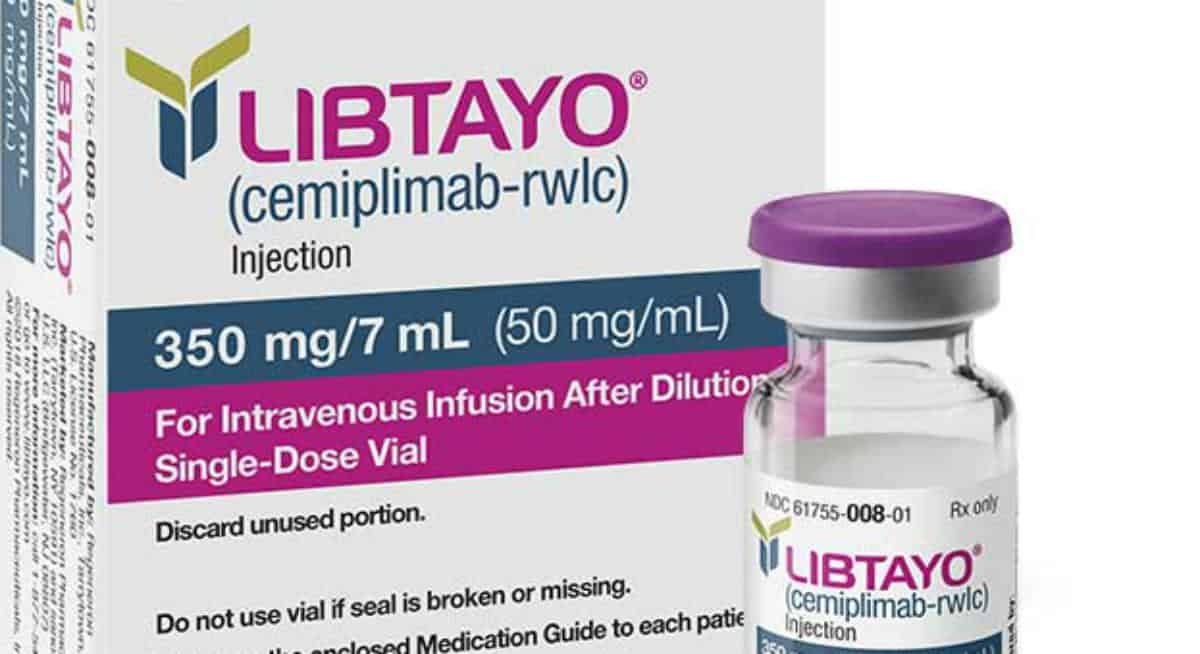

Sanofi is a bit of a latecomer to the cancer immunotherapy category but claimed approval earlier this year for Libtayo (cemiplimab) – the sixth PD-1/PD-L1 inhibitor to reach the market – as a treatment for cutaneous  squamous cell carcinoma (CSCC).

squamous cell carcinoma (CSCC).

The Regeneron-partnered drug is the first drug in the checkpoint inhibitor class to get a green light in that type of skin cancer, and is also being tested in head and neck, colorectal and prostate tumours, as well as melanoma and blood cancers.

Sanofi and Regeneron are also working on bispecific antibody immunotherapies, including two lead candidate targeting BCMA/CD3 and MUC/CD3, respectively.

Sanofi has had a challenging few years following the loss of patent protection for its former diabetes cash cow Lantus (insulin glargine), with some pipeline successes – notably atopic dermatitis and asthma drug Dupixent (dupilumab) – but also failures such as dengue vaccine Dengvaxia and underperforming cholesterol drug Praluent (alirocumab).